SCHEDULE 14A

(Rule 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

¨ |

ProQuest Companyx Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12

PROQUEST COMPANY

(Name of Registrant as Specified inIn Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Thanother than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i) |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ Fee |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Notice of

Year 20032005

Annual Meeting

and

Proxy Statement

ProQuest Company

300 N. Zeeb Road777 Eisenhower Parkway

P.O. Box 1346

Ann Arbor MI 4810348106-1346

April 17, 2003May 2, 2005

Dear Shareholder,

You are invited to attend the Annual Meeting of Shareholders of ProQuest Company (hereinafter referred to as “ProQuest” or the “Company”) to be held at 8:00 a.m. Eastern Time on Wednesday, May 21, 2003,June 15, 2005, at the Ritz-Carlton Hotel, 600 Stockton Street, San Francisco, California.headquarters of ProQuest Company, 777 Eisenhower Parkway, Ann Arbor, Michigan 48106-1346.

The Annual Meeting will begin with voting for directors the 2003 ProQuest Strategic Performance Plan, the appointment of auditors and will continue with other business matters properly brought before the meeting or at any adjournment or postponement of the meeting, and will be followed by mya summary of the Company’s 20022004 performance and a question and answer period.

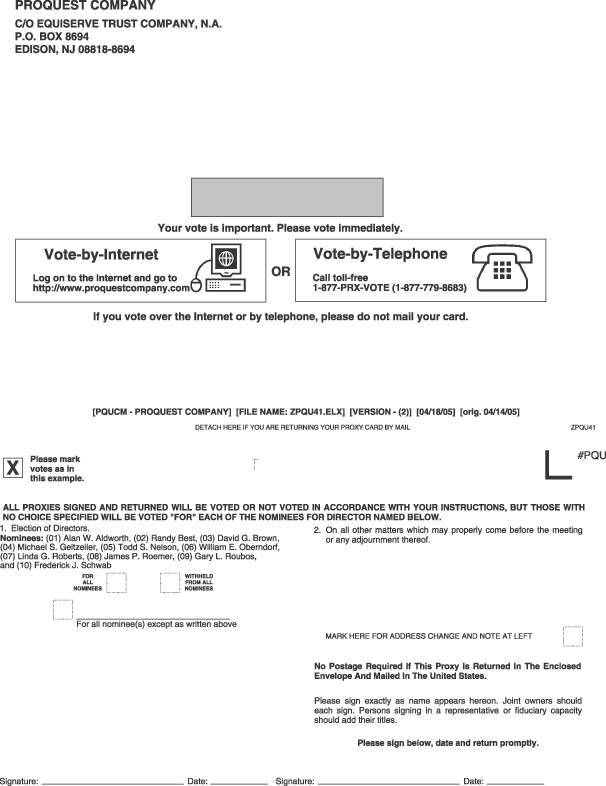

Whether or not you plan to attend, you can be sure your shares are represented at the meeting by promptly completing, signing, and dating the enclosed proxy card and returning it to us in the enclosed envelope. Or, as an alternative method, you may cast your vote via the Internet or by telephone.

Cordially, | ||

| ||

| ||

Chairman of the Board |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Time | 8:00 a.m. Eastern Time on Wednesday, | |

Place |

777 Eisenhower Parkway, Ann Arbor, Michigan 48106-1346 | |

Items of Business | (1) To elect | |

(2) | ||

| ||

| ||

Record Date | You can vote if you are a shareholder of record on | |

Financial Information | Our Form 10-K for the | |

Proxy Voting | It is important that your shares be represented and voted at the meeting. | |

(1) Mark, sign, date and promptly return the enclosed proxy card in the envelope provided; | ||

(2) Vote via the Internet at the website noted on your proxy card; or | ||

(3) Use the toll-free telephone number shown on the proxy card. | ||

You may revoke your proxy at any time before it is exercised by voting in person at the Annual Meeting, by submitting another proxy bearing a later date, or by notifying the Secretary of the Company in writing of your election to revoke it prior to the meeting. Unless you decide to vote your shares in person, you must revoke your prior proxy card in the same way that you initially submitted it – that is, by Internet, telephone or mail. If your shares are held in “street name” through a broker, bank or other third party, you will receive instructions from that third party that you must follow in order for your shares to be voted.

If you plan to attend the meeting, please complete and return the advance registration form on the back page of this Notice of 20032005 Annual Meeting and Proxy Statement, which is being mailed to you on April 17, 2003. An admission card will be waiting for you at the meeting.Statement.

| ||

| ||

Todd W. Buchardt, | ||

| Secretary |

April 17, 2003

May 2, 2005

1 | ||

| 3 | ||

| 7 | ||

| 8 | ||

| 9 | ||

|

| |

| ||

| 12 | ||

| 12 | ||

| 13 | ||

| 13 | ||

| 14 | ||

| 14 | ||

| 14 | ||

COMPENSATION ARRANGEMENTS | ||

| 16 | ||

| 17 | ||

| 19 | ||

| ||

| ||

|

| |

| ||

| ||

| ||

| ||

| ||

| ||

|

| |

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

|

| |

| ||

| ||

| ||

| ||

| ||

| ||

| ||

Householding of Annual Meeting Materials | 23 | |

Other Matters | 23 | |

| ||

back cover | ||

QUESTIONS AND ANSWERS ABOUT VOTING

| Q: | Who can vote? |

| A: | You can vote, if you were a shareholder at the close of business on the record date of |

| Q: | What am I voting on? |

| A: | You are voting on: |

| Q: | How will the proxies vote on any other business brought up at the meeting? |

| A: | By submitting your proxy card, you authorize the proxies to use their judgement to determine how to vote on any other matter brought before the |

| Q: | How do I cast my vote? |

| A: | You may vote your shares in any one of these ways: |

| Q: | How does the Board recommend I vote on the proposals? |

| A: | The Board recommends you vote “for” each of the items on the proxy card. |

| Q: | Can I revoke my proxy card? |

| A: | You may revoke your proxy card by: |

Unless you decide to vote your shares in person, you must revoke your prior proxy card in the same way you initially submitted it–that is, by Internet, telephone, or mail.

| Q: | Who will count the votes? |

| A: | EquiServe Trust Company, N.A. |

| Q: | What shares are included on my proxy card? |

| A: | Your proxy card represents all shares registered to your account with the same social security number and address. |

| Q: | How many votes can I cast? |

| A: | On each matter voted upon, you are entitled to one vote per share. |

| Q: | What is a “quorum”? |

| A: | A quorum is the number of shares that must be present to have the annual meeting. The quorum requirement for the Annual Meeting is a majority of the outstanding shares, present in person or represented by proxy. If you submit a valid proxy card or attend the |

| Q: | How many votes will it take to elect the director nominees? |

| A: | The Directors are elected by a plurality of the votes cast by the shares present in person or by proxy at the Annual Meeting and entitled to vote. |

| Q: |

| A: |

GENERAL INFORMATION FOR SHAREHOLDERS

Information aboutCORPORATE GOVERNANCE.

Our business is managed by the Company’s employees under the direction and oversight of the Board of Directors. Except for Mr. Aldworth, none of the Board members are employees of the Company. The Board limits membership of the Audit Committee, Compensation and Nominating and Governance Committee to independent non-employee Directors as determined by the New York Stock Exchange Listing Standards and the applicable rules of the Securities and Exchange Commission. We keep Board members informed of our business through discussions with management, materials we provide to them, visits to our offices and their participation in Board meetings and Board committee meetings.

The Board of Directors has adopted Corporate Governance Principles which, along with the charters of the Board Committees and Compensation.the Company’s Code of Conduct, provide the framework for the governance of the Company. A complete copy of the Company’s governance principles, the charters of the Board Committees and the Code of Conduct may be found on the Company’s Investor Relations Section of our website atwww.proquestcompany.com.

The Board met in executive session of non-management directors at each of the 2004 meetings. Mr. Oberndorf has been appointed as the lead Director for these meetings.

The Company has established several means for shareholders or others to communicate their concerns to the Board of Directors. If the concern relates to the Company’s financial statements, accounting practices or internal controls, the concern should be submitted in writing to the Chairman of the Audit Committee in care of the Company’s Secretary at the Company’s headquarters’ address. If the concern relates to the Company’s governance practices, business ethics or corporate conduct, the concern may be submitted in writing to the Chairman of the Nominating and Governance Committee in care of the Company’s Secretary at the Company’s headquarters’ address. In addition, shareholders or others may also communicate with the Board via email toboard.directors@proquest.com as described on the Company’s website (www.proquestcompany.com).

The Company’s “whistleblower” policy prohibits the Company or any of its employees from retaliating or taking any adverse action against anyone for raising a concern. If a shareholder or employee nonetheless prefers to raise his or her concern in a confidential or anonymous manner, the concern may be directed to the Office of the Secretary at the Company’s headquarters. The Secretary will refer the concern to the appropriate independent director.

The Board of Directors has determined that as of March 10, 2005, Ms. Roberts and Messrs. Brown, Geltzeiler, Nelson, Oberndorf, Roubos and Schwab are independent under the requirements of the New York Stock Exchange. The Board of Directors presently consists of eightten members. There are currently two vacant positionsno vacancies on the Board. Any vacancy will be filled by a vote of the Board of Directors and such candidate will stand for election at the next Annual Shareholders Meeting. The proxies will not be used to vote to fill these two vacancies.

The Board held seveneight meetings during 2002.2004. Except for Messrs. Roemer and WhiteMr. Nelson who attended all but twothree meetings, the average attendance by Directors at these meetings was greater than 80%, and all directors attended at least 90% of the Committee meetings they were scheduled to attend75%.The Board has an Audit Committee, a Compensation Committee and a newly formed Nominating and Governance Committee.

The Board of Directors encourages all of its members to attend the Annual Meeting of Shareholders. In May 2004, eight of the nine director nominees were present at the Annual Meeting of Shareholders.

Audit Committee. The Independent Audit Committee’s primary responsibilities are:

The Audit Committee met sevenfive times during 2002.2004. Messrs. Roubos (Chairman), Oberndorf,Geltzeiler and Scully areBrown were members of the Audit Committee.Committee in 2004. Mr. Geltzeiler was appointed to the Audit Committee upon Mr. White’s resignation in September 2004. All members attended at least 90% of the Committee meetings. The Audit Committee operates under a formal written charter, which has been approved by the Board and is reviewed periodically.available on the Company’s website (www.proquestcompany.com). All of the members of the Audit Committee are independent under New York Stock Exchange listing standards.standards and the rules of the Securities and Exchange Commission. The Board determined each of the members of the Audit Committee qualifies as an Audit Committee financial expert as defined under the rules and regulations of the Securities and Exchange Commission.

Compensation Committee. The Compensation Committee’s responsibilities are:

This Committee also administers the ProQuest 1995 Employee Stock Option Plan and the Management Incentive Bonus Plan. This Committee met twofive times during 2002.2004. Messrs. Oberndorf (Chairman), Bonderman, and Roubos are members of the Compensation Committee. The members attended all Compensation Committee meetings in 2004. The Compensation Committee operates under a formal written charter which was approved by the Board. All members of the Compensation Committee are independent under the New York Stock Exchange listing standards. The Committee currently has a vacancy due to a recent resignation of a director. The vacancy will be filled by the Board.

Nominating and Governance Committee. The Nominating and Governance Committee’s responsibilities are:

The Nominating and GovernanceThis Committee was initially created by the Board in November, 2002.met four times during 2004. Messrs. Brown (Chairman), Oberndorf and Roubos are members of the Committee. All members attended at least 90% of the Committee meetings. The Nominating and Governance Committee operates under a formal written charter a copy of which is attached as Appendix A.has been approved by the Board. The Charter will beis reviewed periodically by the Board. All of the members of the Nominating and Governance Committee are independent under the New York Stock Exchange listing standards. A copy of the Nominating and Governance Committee Charter is located on the Company’s website atwww.proquestcompany.com.

The Nominating and Corporate Governance Committee will consider board nominees recommended by shareholders. Those recommendations should be sent to the Chair of the Nominating and Governance Committee, care of the Corporate Secretary of ProQuest Company, 777 Eisenhower Parkway, P.O. Box 1346, Ann Arbor, Michigan 48106-1346. In order for a shareholder to nominate a candidate for director, under the Company’s Bylaws, timely notice of the nomination must be given in writing to the Secretary of the Company. To be timely, such notice must be received at the principal executive offices of the Company not less than ninety days prior to the meeting of shareholders. Notice of a nomination must include your name, address and number of shares you own; the name, age, business address, residence address and principal occupation of the nominee; and the number of shares beneficially owned by the nominee. It must also include the information that would be required to be disclosed in the solicitation of proxies for election of directors under the federal securities laws, as well as whether the individual can understand basic financial statements and the candidate’s other board memberships (if any). You must submit the nominee’s consent to be elected and to serve. The Nominating and Governance Committee may require any nominee to furnish any other information, within reason, that may be needed to determine the eligibility of the nominee. As provided in its Charter, the Nominating and Governance Committee will follow procedures which the Committee deems reasonable and appropriate in the identification of candidates for election to the board and evaluating the background and qualifications of those candidates. Those processes include consideration of nominees suggested by an outside search firm, by incumbent board members and by shareholders. The Committee will seek candidates having experience and abilities relevant to serving as a director of the Company and who represent the best interests of shareholders as a whole and not any specific interest group or constituency.

The Committee will consider a candidate’s qualifications and background, including, but not limited to responsibility for operating a public company or a division of a public company, international business experience, a candidate’s technical background or professional qualifications and other public company boards on which the candidate is a director. The Committee will also consider whether the candidate would be “independent” for purposes of the New York Stock Exchange and the rules and regulations of the Securities and Exchange Commission. The Committee may from time to time engage the service of a professional search firm to identify and evaluate potential nominees.

Compensation of Directors. All of the non-employee Directors receive their compensation through cash payments, restricted stock and participation in the 1995 Non-Employee Directors’ Stock Option Compensation Plan:following compensation:

The annual stock option grant to directors is made under the Non-Employee Directors’ Stock Option CompensationProQuest Company Strategic Performance Plan. Each non-employee Board memberDirector receives an annual stock option grant made as of the last day of trading of the Company’sProQuest’s Common stockStock in the second fiscal quarter (June 28, 2002)(July 3, 2004). The stock option grant permits a non-employee Director to purchase shares of the Company’sProQuest’s Common stockStock at an exercise price not less than the market value of the Common stock on the date the option is granted. The number of shares that may be purchased is equal to $25,000 divided by the fair market value of an option of one share of Common stock. stock on the grant date.

For these purposes, the value of an option is determined by using the Black-Scholes option-pricing model. In 20022004, each non-employee Director received an option grant of 1,1362,021 shares of the Company’s Common stockStock at an exercise price of $35.50$27.19 per share. Each non-employee director alsoOn January 4, 2004, Ms. Roberts and Mr. Nelson each received the annual cash retainer of $25,000, plus fees for participation in the Committees. No initial grants2,547 shares of restricted stockCommon Stock. These shares of restricted Common Stock were issued in 2002.determined by dividing $75,000 by the market value of the Common Stock on the trading day immediately prior to January 4, 2004. Furthermore, on September 21, 2004, Mssrs. Geltzeiler and Schwab each received 2,913 shares of restricted Common Stock. These shares were determined by dividing $75,000 by the market value of the Common Stock on September 21, 2004. Mr. Best received 2,095 shares of restricted Common Stock on March 10, 2005 as determined by dividing $75,000 by the market value of the Common Stock on March 10, 2005.

For 2003, each non-employee Director will be entitledPlease see Related Party Transactions related to the following:consulting agreement with Mr. Best.

Employee Directors receiveMr. Aldworth receives no additional compensation for being membersa member of the Board of Directors. Employee Directors

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

EXECUTIVE COMPENSATION

The philosophy of the Compensation Committee is to:

The Company’s compensation program for executive officers currently consists of the following key elements:

Each element of the program has a somewhat different purpose. Salary and annual bonuses are reimbursedmade to compensate ongoing performance and achievement of business objectives through the year based upon established targets and goals. Stock option and restricted stock grants and long term incentive plans are designed to provide strong incentives for creation of long term shareholder value and continued retention of executive officers and other key employees of the Company.

In determining the overall level and form of executive compensation to be paid or awarded in 2004, the Committee considered, among other things, continued increases in the Company’s sales and productivity in a period of rapid change and intensified competition; and the compensation practices and performances of other major corporations which are most likely to compete with the Company for the services of its executive officers.

BASES FOR COMPENSATION

Chief Executive Officer.During 2004, Mr. Aldworth received total cash payments of $625,000 salary and $443,694 in bonuses as shown in the Summary Compensation Table on page 9. In determining Mr. Aldworth’s 2004 compensation, the Compensation Committee focused on his ability to enhance the long-term value of the Company. During his tenure with ProQuest, Mr. Aldworth has been a leader in the revitalization of the Company and its transformation into a provider of technological solutions within a number of market segments. Mr. Aldworth has also been instrumental in improving the capital and debt structure of the Company. Mr. Aldworth’s total compensation is based on both ProQuest’s recent performance and his contributions to the overall long-term strategy and financial strength of the Company.

Executive Officer Base Salary. Base salary for the executive officers, other than the Chief Executive Officer was set by the Chief Executive Officer with the consent of the Compensation Committee. In setting these compensation levels, the Compensation Committee considered a variety of factors, including competitive market levels, levels of responsibility, and the unique abilities and individual experience and performance of each officer.

The purpose of the ProQuest Strategic Performance Plan is to increase stockholder value and maintain an entrepreneurial spirit within the Company by providing significant capital accumulation opportunities to the Company’s officers and other key employees.

DEDUCTIBILITY OF COMPENSATION IN EXCESS OF $1,000,000 PER YEAR

Internal Revenue Code Section 162(m), in general, precludes a public corporation from claiming a tax deduction for compensation in excess of $1,000,000 in any taxable year for any travelexecutive officer named in the summary Compensation table in such corporation’s proxy statement. Certain performance-based compensation is exempt from this tax deduction limitation. The Compensation Committee’s policy is to structure executive compensation in order to maximize the amount of the Company’s tax deduction. However, the Compensation Committee reserves the right to deviate from that policy to the extent it is deemed necessary to serve the best interests of the Company.

*****

The foregoing report on executive compensation is provided by the following members of the Compensation Committee during 2004:

William E. Oberndorf (Chairman) and Gary L. Roubos.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

Messrs. Oberndorf and Roubos are the members of the Compensation Committee. No member of the Compensation Committee is an officer of the Company. No member of the Compensation Committee served as a director or member of the Compensation Committee of another entity, any of whose executive officers served as a director or member of the Compensation Committee of the Company.

COMPENSATION AND STOCK OWNERSHIP INFORMATION

The following table sets forth the compensation paid by the Company or a subsidiary of the Company to the Chief Executive Officer and each of the other four most highly compensated executive officers of the Company at the end of fiscal 2004 for fiscal years 2004, 2003 and 2002:

SUMMARY COMPENSATION TABLE

| ANNUAL COMPENSATION | LONG TERM COMPENSATION | |||||||||||||

Name and Principal Position | Fiscal Year | Salary ($) | Bonus(1) ($) | Other Annual Compensation ($) | Securities Underlying Options(2) (#) | All Other Compensation ($) | ||||||||

Alan W. Aldworth President and Chief Executive Officer, ProQuest Company | 2004 2003 2002 | 625,000 618,942 398,077 | 443,594 529,783 134,470 | 24,253 24,178 51,726 | (8) (8) (8) | 774,395 146,022 80,000 | 174,758 120,923 96,996 | (3) (3) (3) | ||||||

Ronald Klausner President, ProQuest Information and Learning Company | 2004 2003 2002 | 465,000 336,231 | 175,000 327,779 | 367,632 287,737 | (8) (8) | 440,000 100,000 | 118,917 56,435 | (4) (4) | ||||||

Andy H. Wyszkowski President, ProQuest Business Solutions Inc. | 2004 2003 2002 | 300,000 283,654 211,432 | 135,000 171,384 33,744 | 22,907 18,498 2,030 | (8) (8) (8) | 260,000 35,000 23,000 | 70,508 53,610 6,000 | (5) (5) (5) | ||||||

Kevin G. Gregory Senior Vice President, Chief Financial Officer, ProQuest Company | 2004 2003 2002 | 255,771 215,360 190,892 | 106,784 73,616 16,934 | 23,009 19,960 113,425 | (8) (8) (8) | 170,500 23,000 22,000 | 53,840 45,923 45,676 | (6) (6) (6) | ||||||

Todd W. Buchardt Senior Vice President, General Counsel, ProQuest Company | 2004 2003 2002 | 270,400 267,600 257,308 | 112,892 134,736 72,432 | 14,894 30,310 37,215 | (8) (8) (8) | 170,500 19,700 22,000 | 60,770 64,890 63,551 | (7) (7) (7) | ||||||

| (1) | Consists of amounts awarded under the Company’s 100% financial measures bonus plan. The Plan provides a financial incentive for key management employees to focus their efforts on, and achieve, annual financial targets. Payments under the Plan for fiscal 2004 were made in March 2005. |

| (2) | Amounts reflected in this column are for grants of stock options under the Company’s 1995 Stock Option Plan or 2003 Strategic Performance Plan. |

| (3) | For fiscal 2003 and 2002 includes $6,000 and $5,100, respectively, in contributions to the PSRP; for fiscal 2004, 2003 and 2002, includes $2,146, $1,911 and $1,343, respectively for imputed life insurance respectively; for fiscal 2004, 2003 and 2002 includes $172,612, $113,012, and $90,553 respectively, in contributions to the Supplemental Executive Retirement Plan (“SERP”). |

| (4) | For fiscal 2003 includes $6,000 in contributions to the PSRP; for fiscal 2004 and 2003 includes $118,917 and $50,435 respectively in contributions to the SERP. |

| (5) | For fiscal 2003 and 2002 includes $6,000 and $6,000 in contributions to the PSRP respectively; and in fiscal 2004 and 2003 $70,508 and $47,610 respectively in contributions to the SERP. |

| (6) | For fiscal 2003 and 2002, includes $6,000 and $6,000 respectively, in contributions to the PSRP; for fiscal 2004, 2003, and 2002 includes $53,840, $39,923 and $39,676, respectively, in contributions to the SERP. |

| (7) | For fiscal 2003 and 2002, includes $6,000, in contributions to the PSRP; for fiscal 2002 includes $220 for imputed life insurance; for fiscal 2004, 2003, and 2002 includes $60,770, $58,890 and $58,231, respectively, in contributions to the SERP. |

| (8) | For Mr. Aldworth, in fiscal 2004 this includes $24,253 in auto allowance and miscellaneous benefits. For Mr. Klausner, in fiscal 2004 this includes $200,000 signing bonus, $150,000 special bonus and $17,632 in auto allowance and miscellaneous benefits. For Mr. Wyszkowski, in fiscal 2004 this includes $22,907 in auto allowance and miscellaneous benefits. For Mr. Gregory, in fiscal 2004 this |

includes $23,009 in auto allowance and miscellaneous benefits. For Mr. Buchardt, in fiscal 2004 this includes $14,894 in auto allowance and miscellaneous benefits. |

For Mr. Aldworth, in fiscal 2003 this includes $24,178 in auto allowance and miscellaneous benefits. For Mr. Klausner, in fiscal 2003 this includes $225,000 new hire signing bonus, $53,049 in relocation expenses incurredand $9,688 in auto allowance and miscellaneous benefits. For Mr. Wyszkowski, in fiscal 2003 this includes $18,498 in auto allowance and miscellaneous benefits. For Mr. Gregory, in fiscal 2003 this includes $1,618 special bonus and $18,342 in auto allowance and miscellaneous benefits. For Mr. Buchardt, in fiscal 2003 this includes $164 special award and $30,146 in auto allowance and miscellaneous benefits.

For Mr. Aldworth, in fiscal 2002 this includes a $32,283 bonus and $19,443 in auto allowance and miscellaneous benefits. For Mr. Wyszkowski, in fiscal 2002 this includes $2,030 in miscellaneous benefits. For Mr. Gregory, in fiscal 2002 this includes $99,848 special bonus and $13,577 in auto allowance and miscellaneous benefits. For Mr. Buchardt, in fiscal 2002 this includes $18,848 as a bonus for successfully completing the Company offering and $18,367 in auto allowance and miscellaneous benefits.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table lists information concerning the stockholders known by the Company to beneficially own more than five percent of the Company’s Common stock as of April 29, 2005, except as noted in the footnotes below.

Name and Address of Beneficial Owner | Number of Shares | Percent | |||

Tweedy, Browne Company LLC(1) 350 Park Avenue New York NY 10022 | 3,960,634 | 13 | % | ||

William E. Oberndorf(3,4) SPO Partners & Co. 591 Redwood Highway Suite 3215 Mill Valley, CA 94941 | 3,524,410 | 12 | % | ||

SPO Advisory Corp.(5) 591 Redwood Highway Suite 3215 Mill Valley, CA 94941 | 3,072,500 | 10 | % | ||

Keystone Inc.(2) 3100 Texas Commerce Tower 201 Main Street Fort Worth, TX 76102 | 2,612,999 | 9 | % | ||

Artisan Partners Limited Partnership(6) 875 E. Wisconsin Avenue, Ste. 800 Milwaukee, WI 53208 | 1,490,200 | 5 | % | ||

| (1) | Pursuant to Tweedy Browne Company LLC’s Schedule 13G (Amendment No. 3) dated January 15, 2004. |

| (2) | Pursuant to Keystone, Inc.’s Schedule 13G (Amendment No. 4) dated February 4, 2003. |

| (3) | Pursuant to a Form 5 dated December 31, 2004, Mr. Oberndorf, through his relationships with SPO Partners II, L.P., SPO Advisory Partners, L.P., SPO Advisory Corp. and SF Advisory Partners, L.P., may be deemed to share investment and voting control with respect to 3,072,500 shares. |

| (4) | Includes 451,910 shares that Mr. Oberndorf may be deemed to beneficially own through his control of family trusts and through his ownership of options to purchase 15,062 shares that are currently exercisable. |

| (5) | As general partner of SF Advisory Partners, L.P., SPO Partners II, L.P. and SPO Advisory Partners L.P., SPO Advisory Corp. may be deemed to share investment and voting control with respect to these shares. Messrs. William Oberndorf, John Scully and William Patterson are the three controlling persons of SPO Advisory Corp. |

| (6) | Pursuant to Artisan’s Partners Limited Partnership’s Schedule 13G dated January 26, 2005. The shares listed above have been acquired on behalf of discretionary clients by Artisan Partners Limited Partnership. |

OWNERSHIP INFORMATION OF DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth information with respect to the beneficial ownership of ProQuest Common stock, as of April 29, 2005 of the Company’s Directors, the executive officers listed in the “Summary Compensation” table above, and the directors and executive officers as a group.

Directors and Executive Officers: | Number of Shares | Percent | |||

William E. Oberndorf(1,2) | 3,524,410 | 12 | % | ||

Alan W. Aldworth(3) | 323,391 | * | |||

Randy Best(7) | 236,304 | * | |||

James P. Roemer(3) | 142,561 | * | |||

Todd W. Buchardt(3) | 103,648 | * | |||

Ronald D. Klausner(3) | 67,621 | * | |||

Kevin G. Gregory(3) | 65,933 | * | |||

Andrew H. Wyszkowski(3) | 53,333 | * | |||

Gary L. Roubos(4) | 19,024 | * | |||

David G. Brown(5) | 17,320 | * | |||

Todd S. Nelson(6) (7) | 4,568 | * | |||

Linda G. Roberts(6) (7) | 4,568 | * | |||

Michael Geltzeiler(7) | 2,913 | * | |||

Frederick Schwab(7) | 2,913 | * | |||

All directors and executive officers as a Group (14 Persons) | 4,568,507 | 15 | % | ||

| * | less than 1%. |

| (1) | Mr. Oberndorf through relationships with SPO Advisory Corp., SPO Advisory Partners, L.P. and SF Advisory Partners, L.P., may be deemed to share investment and voting control with respect to 3,072,500 shares. |

| (2) | Includes 449,889 shares that Mr. Oberndorf may be deemed to beneficially own through his control of family trusts and includes 15,062 shares granted under the Company’s stock option plans which are currently exercisable. |

| (3) | Includes 220,380; 77,000; 97,133; 66,666; 65,433 and 53,333 option shares for Messrs. Aldworth; Roemer; Buchardt; Klausner; Gregory and Wyszkowski respectively, granted under the Company’s stock option plans, which are currently exercisable. |

| (4) | Includes 15,062 option shares granted under the Company’s stock option plans which are currently exercisable. |

| (5) | Includes 11,891 shares granted under the Company’s stock option plans which are currently exercisable. |

| (6) | Includes 2,021 shares granted under the Company’s stock option plans which are currently exercisable. |

| (7) | Includes 2,547; 2,095; 2,547; 2,095; and 2,913 shares of restricted Company Common Stock for Ms. Roberts and Mssrs. Best; Geltzeiler; Nelson; and Schwab, respectively. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires that certain of the Company’s directors, executive officers and 10% shareholders (“Insiders”) file with the Securities & Exchange Commission (SEC) and the New York Stock Exchange reports disclosing their beneficial ownership and any changes in ownership of the Company’s common stock. Based upon review of such reports it has received and based upon written representations that no other reports were required, the Company is not aware of any instances of noncompliance or late compliance with 16(a) filing requirements during the year ended December 31, 2004, except for the following: a late filing on Form 4 made on July 12, 2004 by each of David Brown; Todd Nelson; Gary Roubos; and Linda Roberts to report options granted on July 2, 2004; and a late filing on Form 4 made on February 10, 2004 for Alan Aldworth; Andrew Wyszkowski; and Ronald Klausner to report options granted on February 4, 2004.

| II. | OPTION GRANTS IN LAST FISCAL YEAR(1) |

The following table sets forth information concerning stock options granted in fiscal 2004 to the named executive officers in the Summary Compensation Table.

| Individual Grants | Potential Realizable Value of Assumed Annual Rates of Stock Price Appreciation for Option Term(1) | |||||||||||||

| Number of Securities Underlying Options Granted(2) (#) | Percent of Total Options Granted to Employees in Fiscal Year | Exercise ($/Sh) | Expiration Date | 5% ($) | 10% ($) | |||||||||

Name | ||||||||||||||

Alan W. Aldworth | 750,000 24,395 | (3) | 34.37 1.12 | % % | 30.97 25.82 | 02/04/10 03/05/09 | 14,607,650 396,127 | 37,018,653 1,003,865 | ||||||

Todd W. Buchardt | 170,500 | 7.81 | % | 30.97 | 02/04/10 | 3,320,806 | 8,415,574 | |||||||

Kevin G. Gregory | 170,500 | 7.81 | % | 30.97 | 02/04/10 | 3,320,806 | 8,415,574 | |||||||

Ronald Klausner | 440,000 | 20.16 | % | 30.97 | 02/04/10 | 8,569,821 | 21,717,610 | |||||||

Andrew H. Wyszkowski | 260,000 | 11.92 | % | 30.97 | 02/04/10 | 5,063,985 | 12,833,133 | |||||||

| (1) | Amounts in these columns represent the potential value which a holder of the option may realize at the end of the option’s term assuming the annual rates of growth specified in the columns before payment of federal or state taxes associated with the exercises. The value of the options has not been discounted to reflect present values. These amounts are not intended to forecast possible future appreciation, if any, of ProQuest’s stock price. |

| (2) | This column represents the number of options granted to each named executive officer in 2004. These options have a ten year term and become exercisable based upon achievement of stock price targets beginning April 2007. The exercised price is equal to the fair market value of the shares covered by each option on the date each option was granted. |

| (3) | In fiscal 2004 Mr. Aldworth received these options by exercising the replacement option feature from previous grants. These options have a six year term and become exercisable annually in 33.33% increments, beginning on anniversary date. The exercise price is equal to the fair market value of the shares covered by each option on the date each option was granted. |

| III. | OPTION EXERCISE AND FISCAL YEAR-END VALUE TABLE |

The following table sets forth the number and value of options exercised in fiscal 2004 and the number and value of unexercised “in-the-money” options held at the end of fiscal 2004.

| Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values (1) | ||||||||||||

| Shares Acquired on Exercise (#) | Value Realized ($)(2) | Number of Securities Underlying Unexercised Options at Fiscal Year-End | Value of Unexercised In-the-Money Options at Fiscal Year-End(1) | |||||||||

Name | (#) Exercisable | (#) Unexercisable | ($) Exercisable | ($) Unexercisable | ||||||||

Alan W. Aldworth | 30,581 | 229,663 | 182,093 | 852,001 | 497,871 | 858,054 | ||||||

Ronald Klausner | 0 | 0 | 33,333 | 506,667 | 284,997 | 570,003 | ||||||

Kevin G. Gregory | 0 | 0 | 50,432 | 193,168 | 272,628 | 174,654 | ||||||

Andy H. Wyszkowski | 0 | 0 | 38,999 | 291,001 | 282,176 | 279,224 | ||||||

Todd W. Buchardt | 0 | 0 | 89,800 | 184,400 | 432,596 | 74,787 | ||||||

| (1) | Value is calculated as of December 31, 2004, the last trading day of fiscal 2004, and is equal to the number of shares of common stock multiplied by the difference between the closing price of a share of ProQuest’s common stock ($29.70) and the exercise price. |

| (2) | Value is calculated based upon the difference between the per-share option exercise price and the market value of a share of ProQuest’s common stock on the date of exercise, multiplied by the applicable number of shares. |

EQUITY COMPENSATION PLAN INFORMATION

Plan Category | Number of securities to be issued upon exercise of outstanding options and rights | Weighted-average exercise price of outstanding options and rights | Number of securities remaining available for future issuance under equity compensation plans | ||||

| (in thousands) | (in thousands) | ||||||

Equity compensation plans approved by security holders | 4,129 | $ | 28.63 | 449 | |||

Equity compensation plans not approved by security holders | — | — | — | ||||

Total | 4,129 | $ | 28.63 | 449 | |||

| (a) | The number of securities and weighted average exercise price in the foregoing table are as of January 1, 2005. |

A Supplemental Executive Retirement Plan (“SERP”) was established, effective January 1, 2001, which provides for annual contributions to be made to selected participant’s recordkeeping accounts within a “Rabbi” Trust arrangement. As of December 31, 2004, the deferral account of each eligible participant is credited with employer contributions in an amount equal to 15% of the sum of the participant’s salary and management bonus for that year. These employer contributions (and investment gains and losses attributable to them) are subject to a vesting schedule as provided below.

The vested amount will be the amount payable to the participant, and the remainder of the participant’s SERP account shall be forfeited. As of the end of the 2004 plan year, Mr. Aldworth was credited with a contribution of $172,611.75 (67% of which was vested); Mr. Buchardt was credited with a contribution of $60,770.49 (100% of which was vested); Mr. Wyszkowski was credited with a contribution of $70,707.56 (67% of which was vested); Mr. Klausner was credited with a contribution of $118,916.79 (0% of which was vested); and Mr. Gregory was credited with a contribution of $53,839.59 (100% of which was vested).

On March 10, 2004, the Company’s Board of Directors appointed Randy Best to serve as a member of the Company’s Board of Directors. Mr. Best was the Chief Executive Officer, and held 34% of the common stock, of Voyager Expanded Learning, Inc. (“Voyager”) immediately prior to the Company’s acquisition of Voyager. In connection with the Company’s acquisition of Voyager, Mr. Best and the Company entered into a Consulting Agreement (the “Consulting Agreement”) and a three year Non-Disclosure, Nonsolicitation and Non-Competition Agreement (the “Non-Competition Agreement”), both of which became effective on January 31, 2005. The Consulting Agreement requires that Mr. Best (a) actively participate with the Company and Voyager to retain and develop client and referral sources, (b) actively participate in major sales calls at the federal, state, and district levels, (c) assist in the development of a “new account” strategy, (d) assist in the development of a government relations strategy at the federal and state level, (e) introduce and transition key contacts for Voyager’s business and (f) perform transition and integration services related to the businesses of the Company and Voyager. As compensation for these services, Mr. Best is entitled to a payment of $40,000 per month for the first six months of the term and $26,666 per month for the last eighteen months of the term of the Consulting Agreement. The Company may terminate the Consulting Agreement upon 60 days’ prior written notice.

The Non-Competition Agreement provides that Mr. Best will not disclose or use the confidential information of Voyager or the Company in any way, except on behalf of the Company or Voyager. Mr. Best also agreed that for three years after January 31, 2005, and for the term of the Consulting Agreement, that he would

not, directly or indirectly, engage or participate in: (i) any capacity, anywhere in the United States, in any business that is competitive to the business operated by Voyager or in which Voyager has currently planned to engage; (ii) recruiting or soliciting any person to leave his or her employment with the Company or Voyager; and (iii) hiring or engaging any person who is or was an employee of Voyager from January 31, 2005 through and including the time of such hiring or engagement. In the agreement, Mr. Best acknowledged that Voyager is or plans to be engaged in the business of: (i) developing, marketing, and selling reading and math-related materials for use by students in grades K-12; and (ii) developing, marketing, and selling programs that are designed to enhance the ability of teachers and school districts to teach reading to students in grades K-12. The Non-Competition Agreement does not prevent Mr. Best from continuing his involvement with GlobalEd Holdings Ltd. and EdCollege, Inc. to the extent that those entities, or affiliates thereof, do not engage in the business of: (i) developing, marketing, or selling reading and math-related materials for use by students in grades K-12; (ii) developing, marketing, or selling any courses, products or services substantially similar to the “Reading for Understanding” and “Foundations of Reading” programs offered by Voyager as of January 31, 2005 to be used by administrators or teachers in grades K-12; and (iii) developing, marketing, or selling programs for any reading based curriculum to those customers who are currently customers of VoyagerU, a division of Voyager.

ProQuest Information and Learning Company had sales of approximately $750,000 to Apollo Library and its affiliates in 2004. Mr. Nelson is the President of Apollo Learning. The sales were an arms length transaction and the relationship with Apollo Library was prior to Mr. Nelson’s directorship. ProQuest Information and Learning Company also made royalty payments of $26,025 to Get a Clue, LLC, a subsidiary of Core Learning Group, LLC in 2004. Mr. Oberndorf is a principal of Core Learning Group LLC. ProQuest Company engaged Ms. Roberts as a consultant related to the Voyager Learning acquisition and paid her approximately $12,000 in 2004.

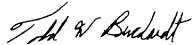

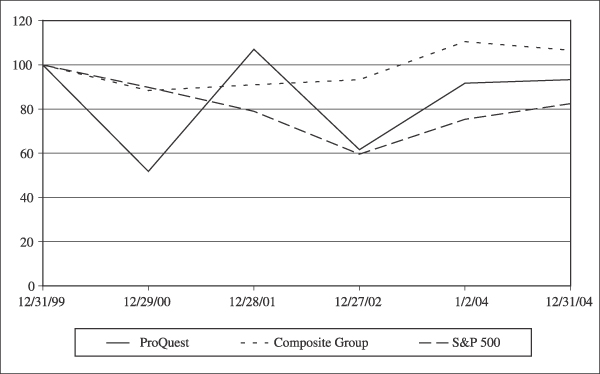

PERFORMANCE GRAPH: FISCAL 2004

Comparison of Cumulative Total Return Among ProQuest,

Composite Group and S&P 500

The following graph compares the cumulative total return of the Company’s Common Stock as compared with the S&P 500 Stock Index and the S&P Publishing Index (“Composite Group”) from December 31, 1999 to January 1, 2005. The comparisons reflected in the graph and table are not intended to forecast the future performance of the Company’s Common Stock and may not be indicative of future performance.

The graph assumes a $100 investment made on December 31, 1999 and the reinvestment of all dividends, as follows:

| Dollar Value of $100 Investment at | ||||||||||||||||||

December 31, 1999 | December 29, 2000 | December 28, 2001 | December 27, 2002 | January 2, 2004 | December 31, 2004 | |||||||||||||

ProQuest | $ | 100.00 | $ | 51.86 | $ | 107.09 | $ | 61.61 | $ | 91.69 | $ | 93.36 | ||||||

Composite Group | $ | 100.00 | $ | 88.44 | $ | 90.94 | $ | 93.29 | $ | 110.47 | $ | 106.54 | ||||||

S&P 500 | $ | 100.00 | $ | 89.86 | $ | 79.02 | $ | 59.58 | $ | 75.44 | $ | 82.48 | ||||||

The responsibilities of the Audit Committee, which are set forth in the Audit Committee Charter, include providing oversight to the Company’s financial reporting process through periodic meetings with the Company’s independent accountants and management to review accounting, auditing, internal controls and financial reporting matters. The Audit Committee is also responsible for the appointment, compensation and oversight of the Company’s independent auditors. The management of the Company is responsible for the preparation and integrity of the financial reporting information and related systems of internal controls. The Audit Committee, in carrying out its role, relies on the Company’s senior management, including senior financial management, and its independent accountants.

With regard to the 2004 audit, the Audit Committee discussed with the Company’s independent auditors the scope, extent and procedures for their attendance at these meetings.audits. Following the completion of the audits, the Audit Committee met with the independent auditors, with and without management present, to discuss the results of their examinations, the cooperation received by the auditors during the audit examination, their evaluation of the Company’s internal control over financial reporting and the overall quality of the Company’s financial reporting.

We have reviewed and discussed with senior management the Company’s audited financial statements included in the 2004 Annual Report to Shareholders. Management has confirmed to us that such financial statements (i) have been prepared with integrity and objectivity and are the responsibility of management and, (ii) have been prepared in conformity with accounting principles generally accepted in the United States of America.

We have discussed with KPMG LLP, our independent accountants, the matters required to be discussed by Statement of Auditing Standards (“SAS”) No. 61, “Communications with Audit Committee.” SAS No. 61 requires our independent accountants to provide us with additional information regarding the scope and results of their audit of the Company’s financial statements, including with respect to (i) their responsibility under auditing standards generally accepted in the United States of America, (ii) significant accounting policies, (iii) management judgements and estimates, (iv) any significant audit adjustments, (v) any disagreements with management, and (vi) any difficulties encountered in performing the audit.

We have received from KPMG LLP a letter providing the disclosures required by Independence Standards Board Standard No. 1 “Independence Discussions with Audit Committees” with respect to any relationships between KPMG LLP and the Company that in their professional judgment may reasonably be thought to bear on independence. KPMG LLP has discussed its independence with us, and has confirmed in such letter that, in its professional judgement, it is independent of the Company within the meaning of the federal securities laws.

Based on the review and discussions described above with respect to the Company’s audited financial statements included in the Company’s 2004 Annual Report to Shareholders, we have recommended to the Board of Directors that such financial statements be included in the Company’s Annual Report on Form 10-K for filing with the Securities and Exchange Commission.

The Audit Committee also reviewed management’s process designed to achieve compliance with Section 404 of the Sarbanes-Oxley Act of 2002 and received periodic updates regarding management’s progress. As specified in the Audit Committee Charter, it is not the duty of the Audit Committee to plan or conduct audits or to determine that the Company’s financial statements are complete and accurate and in accordance with accounting principles generally accepted in the United States of America. That is the responsibility of management and the Company’s independent accountants. In giving our recommendation to the Board of Directors, we have relied on (i) management’s representation that such financial statements have been prepared with integrity and objectivity and in conformity with accounting principals generally accepted in the United States of America, and (ii) the report of the Company’s independent accountants with respect to such financial statements.

The foregoing report of the Audit Committee does not constitute soliciting material and shall not be deemed incorporated by reference by any general statement incorporating by reference the Proxy Statement into any filing by the Company under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that we specifically incorporate this information by reference, and shall not otherwise be deemed filed under such acts.

Audit Committee |

Gary L. Roubos (Chairman) |

David G. Brown |

Michael Geltzeiler |

The Company’s certified public accountant for fiscal 2004 was KPMG LLP and that firm has been selected as the Company’s accountants for fiscal 2005 by the Audit Committee. Such accounting firm is expected to have a representative at the Annual Meeting of Shareholders and will be available to respond to appropriate questions at that time and have an opportunity to make a statement if they desire to do so.

Audit Fees.

The following table presents fees for professional audit services rendered by KPMG LLP for the audit of the Company’s annual financial statements for fiscal years 2004 and 2003 and fees billed for other services rendered by KPMG LLP.

| 2004 | 2003 | |||||

Audit fees(1) | $ | 1,893,137 | $ | 637,800 | ||

Audit related fees(2) | $ | 31,695 | $ | 53,000 | ||

Audit and audit related fees | $ | 1,924,832 | $ | 690,800 | ||

Tax fees(3) | $ | 67,152 | $ | 145,651 | ||

All other fees | $ | 0 | $ | 9,439 | ||

Total fees | $ | 1,991,984 | $ | 845,940 | ||

| (1) | Audit services consisted of the audit of financial statements included in the Company’s Annual Report on Form 10-K, reviews of the financial statements included in the Company’s Quarterly Reports on Form 10-Q, attestation of the effectiveness of the Company’s internal controls over financial reporting, and providing comfort letters in connection with ProQuest Company funding transactions. |

| (2) | Audit related fees consisted principally of fees for audits of financial statements of employee benefit plans, business acquisitions and divestitures assistance, and accounting consultations and related services. |

| (3) | Tax fees consisted of fees for tax consultation and tax compliance services. |

Pre-approval of Services by the External Auditor.

The Audit Committee has adopted a policy for pre-approval of audit and permitted non-audit services by the Company’s external auditor. The Audit Committee will consider annually and, if appropriate, approve the provision of audit services by its external auditor and consider and, if appropriate, pre-approve the provision of certain defined audit and non-audit services. The Audit Committee will also consider on a case-by-case basis and, if appropriate, approve specific engagements that are not otherwise pre-approved. The Audit Committee pre-approved all audit, audit related and permitted non-audit services by the Company’s external auditors in 2004.

Any proposed engagement that does not fit within the definition of a pre-approved service may be presented to the Audit Committee for consideration at its next regular meeting or, if earlier consideration is required, to the Audit Committee or one or more of its members. The member or members to whom such authority is delegated shall report any specific approval of services at its next regular meeting. The Audit Committee will regularly review summary reports detailing all services being provided to the Company by its external auditor.

The Audit Committee has advised the Company that it has determined that the non-audit services rendered by the Company’s independent accountants during the Company’s most recent fiscal year are compatible with maintaining the independence of such accountants.

PROPOSAL 1. ELECTION OF DIRECTORS

INFORMATION ABOUT THE NOMINEES FOR DIRECTOR

The names of the persons who have been nominated by the Board for election as Directors at the Annual Meeting are set forth below. There are no other nominees. All nominees have consented to serve as Directors if elected.

If any nominee becomes unable to serve as a Director, the proxies will be voted by the proxy holders for a substitute person nominated by the Board, and authority to do so is included in the Proxy. The term of office of each nominee who is elected extends until the Annual Meeting of Shareholders in 20042005 and until his or her successor is elected and qualified.

Mssrs. Best; Geltzeiler; and Schwab have been appointed to the Board since the last election of directors. Mssrs. Geltzeiler and Schwab were initially recommended to the Nominating and Governance Committee by other non-management directors and a third party search firm. Mr. Best was initially recommended to be appointed to the Board in connection with the Voyager Expanded Learning acquisition. He was approved by the Nominating and Governance Committee and the Board.

James P. RoemerAlan Aldworth, 50, 55, has been Chairman of the Board since May 2004 and has been President and Chief Executive Officer of the Company since January 2003. In January 2002, he was elected President and Chief Operating Officer of ProQuest. Mr. Aldworth joined ProQuest as Vice President and Chief Financial Officer in October 2000. Prior to joining ProQuest, he spent 18 years at Tribune Company where he held a variety of senior financial management and general management positions, the most recent of which was as the General Manager of Tribune Education Company.

Randy Best, 62, has been a director since March 10, 2005 and is the chairman and chief executive officer of GlobalEd Holdings, Ltd. He is the co-founder, former chairman and chief executive officer of Voyager Expanded Learning, which was acquired by ProQuest in January 2005. Since the acquisition, Mr. Best has served as a consultant to ProQuest Company. Mr. Best is an advisory board member for the Education Commission of the States and a member of the National Education Association Foundation Board, the College of Education Foundation Advisory Council for the University of Texas at Austin, and the National Urban Alliance Board for Columbia University. He is also a benefactor of the Smithsonian Institution. Previously, he served on the White House Millennium Committee and The Foundation Leadership Network. Mr. Best is a graduate of Lamar University.

David G. Brown, 48, has been a Director of the Company since January 1994. He has been the Managing Partner of Oak Hill Venture Partners since August 1999 and a Principal in Arbor Investors LLC since August 1995, Chief Financial Officer of Keystone, Inc. from September 1998 to February 2000, and a Vice President of Keystone, Inc. since August 1993. Prior to joining Keystone, Mr. Brown was a Vice President in the Corporate Finance Department of Salomon Brothers Inc. from August 1985 to July 1993. He is a Director of eGain Communications, Lattice Communications, Lightning Finance, MarketTools, Perfect Commerce, Sandial Networks, Sitara Networks and WOW Networks.

Michael Geltzeiler, 46, has been a director since September 2004 and serves on the Audit Committee. He is Senior Vice President and Chief Financial Officer of The Reader’s Digest Association, Inc., a position he has held since 2001. Prior to joining The Reader’s Digest, Mr. Geltzeiler, a certified public accountant, was with ACNielsen and Dun & Bradstreet (now known as D&B). Mr. Geltzeiler is also a member of the Board of Directors for the Madison Square Boys and Girls Club and the Westchester County Association.

Todd S. Nelson, 45, has been a director since January 4, 2004. He has been Chief Executive Officer of Apollo Group, Inc. since August 2001 and President since February 1998. Mr. Nelson joined Apollo Group in 1987 as Director of University of Phoenix’s Utah campus, became Executive Vice President of the University of

Phoenix in 1989, and became Vice President of Apollo Group, Inc. in 1994. Prior to joining Apollo Group, he was General Manager, from 1985 to 1987, at Amembal and Isom, a management training company. From 1984 to 1985, Mr. Nelson was General Manager of Vickers & Company, a diversified holding company. From 1983 to 1984, he was a marketing director at Summa Corporation, a recreations properties company, as well as a faculty member at the University of Nevada at Las Vegas. Mr. Nelson is a director of Apollo Group, Inc.

William E. Oberndorf, 52, has been a Director of the Company since July 1988. He has served as Managing Director of SPO Partners & Co. since March 1991. He is also a director of Rosewood Hotels and Resorts and a board member emeritus of Plum Creek Timber Co., Inc.

Linda G. Roberts, 63, has been a director since January 4, 2004. Since leaving government in January 2001, Roberts has served as advisor, consultant, and board director in various organizations, including state and local governments, foundations, non-profit organizations, corporations and start-up companies. Prior to that, Dr. Roberts directed the U.S. Department of Education’s Office of Educational Technology from its inception in September 1993 to January 2001, and served as the Secretary of Education’s Special Advisor on Technology. From 1984 to 1993, she led the research on educational technology at the Congressional Office of Technology Assessment. Dr. Roberts also served as an advisor to the Children’s Television Workshop during the development of “Sesame Street” and “The Electric Company.” From 1981 to 1984, she served the U.S. Department of Education in the Office of Libraries and Learning Technologies and the Office of Educational Research and Improvement. Dr. Roberts is a Senior Advisor to Carnegie Learning, Inc., Classroom Connect, Apple Computer and several leading technology companies. She is a Trustee of the Board of the Sesame Workshop, and a Trustee of the Education Development Corporation. Dr. Roberts is also a director of Wireless Generation and Carnegie Learning, Inc.

James P. Roemer, 57, served as Chairman of the Board from January 1998 to May 2004 and has been a Director of the Company since February 1995. From January 2002 to January, 2003, Mr. Roemer also served as our Chief Executive Officer. From February 1997 to January 2003, he served as President and Chief Executive Officer of the Company. From February 1995 to February 1997 he served as President and Chief Operating Officer of the Company. Prior to that, he served as President and Chief Executive Officer of ProQuest Information and Learning Company from January 1994 to June 1995. Mr. Roemer joined ProQuest as Vice President and Bell & Howell Publishing Services Company as President and Chief Operating Officer in October 1991 and was promoted to President and Chief Executive Officer of Bell & Howell Publishing Services Company in September 1993. Prior to joining ProQuest, Mr. Roemer was President of the Michie Group, Mead Data Central from December 1989 to October 1991. From January 1982 to December 1989 he was Vice President and General Manager of Lexis, an on-line information service. From April 1981 to December 1982 he served as acting President of Mead Data Central.

Alan Aldworth,48, has been President and Chief Executive Officer of the Company since January 2003. In January 2002, he was elected President and Chief Operating Officer of ProQuest. Mr. Aldworth joined ProQuest as Vice President and Chief Financial Officer in October 2000. Prior to joining ProQuest, he spent 18 years at Tribune Company where he held a variety of senior financial management and general management positions, the most recent of which was as the General Manager of Tribune Education Company.

David Bonderman, 60, has been a Director of the Company since December 1987. He is the founding Partner of Texas Pacific Group (a private investment company) and has been the Managing General Partner since December 1992. He is also a Director of the following public companies: Co-Star Group, Inc.; Continental Airlines, Inc.; Denbury Resources, Inc.; Ducati Motor Holding S.p.A.; Magellan Health Services, Inc.; Paradyne Networks, Inc.; ON Semiconductor Corporation; and Ryanair Ltd.

David G. Brown, 46, has been a Director of the Company since January 1994. He has been the Managing Partner of Oak Hill Venture Partners since August 1999 and a Principal in Arbor Investors LLC since August 1995, Chief Financial Officer of Keystone, Inc. from September 1998 to February 2000, and a Vice President of Keystone, Inc. since August 1993. Prior to joining Keystone, Mr. Brown was a Vice President in the Corporate Finance Department of Salomon Brothers Inc. from August 1985 to July 1993. He is a Director of AER Energy Resources, eGain Communications, FEP Holdings, Lattice Communications, Lightning Finance, MarketTools, Sitara Networks and WOW Networks.

William E. Oberndorf, 49, has been a Director of the Company since July 1988. He has served as Managing Director of SPO Partners & Co. since March 1991. HeRoemer is also a director of Rosewood Hotels and Resorts and a board member emeritus of Plum Creek Timber Company.Advent Software.

Gary L. Roubos, 66,68, has been a Director of the Company since February 1994. He was Chairman of the Board of Dover Corporation from August 1989 to May 1998 and was President from May 1977 to May 1993. He is also a Director of Dover Corporation and Omnicom Group Inc.

John H. Scully, 58, has been a Director of the Company since July l988. He has served as Managing Director of SPO Partners & Co. since March l99l. He is also a Director of Plum Creek Timber Company, Inc.

WilliamFrederick J. WhiteSchwab, 64, has been a Directordirector since September 2004. He was President and CEO of Porsche Cars North America (PCNA) from 1992 to 2003. He joined PCNA in 1985 as Executive Vice President of Finance & Administration and was appointed Senior Vice President in 1988. Prior to joining PCNA, Mr. Schwab, a certified public accountant, was with Fruehauf Corp. and Touche Ross & Company. Currently, Mr. Schwab serves on the Board of Michigan State University’s Eli Broad College of Business, the National Board of Directors of the Company since February 1990 and was Chairman ofHope Foundation, the Board from February 1990of Trustees at the Atlanta International School, and the Board of Governors at the Ravinia Club. He also serves as a director to January 1998. He served as Chief Executive Officer of the Company from February 1990 to February 1997Indus International Inc., and was President of the Company from February 1990 to February 1995. Since January 1998 he has been a Professor of Industrial Engineering and Management Science at Northwestern University. He is also a Director of Packaging Dynamics Corporation and Readers Digest Association, Inc.Boyd Gaming Corporation.

Shareholders are being requested at the Meeting to elect the eightnine nominees to serve as members of the Board for the ensuing year. The Board recommends a vote “FOR” approval of the Proposal.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The philosophy of the Compensation Committee is to:

The Company’s compensation program for executive officers currently consists of the following key elements:

Each element of the program has a somewhat different purpose. Salary and annual bonuses are made to compensate ongoing performance and achievement of business objectives through the year based upon established targets and goals. Stock option grants are designed to provide strong incentives for creation of long term shareholder value and continued retention of executive officers and other key employees of the Company.

In determining the overall level and form of executive compensation to be paid or awarded in 2002, the Committee considered, among other things, continued increases in the Company’s sales and productivity in a period of rapid change and intensified competition; and the compensation practices and performances of other major corporations which are most likely to compete with the Company for the services of its executive officers.

BASES FOR CHIEF EXECUTIVE OFFICER COMPENSATION

For 2002, Mr. Roemer received total cash payments of $675,002.00 salary and $823,022.00 bonuses, as shown in the Summary Compensation Table on page10.

At the beginning of fiscal year 2001 (dated December 31, 2000) the Compensation Committee implemented an arrangement with Mr. Roemer to provide long term incentive benefits based upon appreciation of the ProQuest stock price. This arrangement is comprised of the following two elements:

The stock option exercise price is equal to the fair market value of the date of the grant, $16.50 per share. If Mr. Roemer continues to be employed by the Company after December 31, 2003, 50% of the option grant may be exercisable on or after December 31, 2003, another 25% may be exercised on or after December 31, 2004 and the remaining 25% may be exercised on or after December 31, 2005.

Due to the increase in the Company’s stock price since December 31, 2000, all of the options have vested and 100% of the performance percentage of the mirror cash payment has been achieved. The performance percentage of the grant and the mirror cash payment were achieved based upon the following table:

|

| ||

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Subject to the following exceptions, the mirror cash element of Mr. Roemer’s incentive compensation arrangement is similar to the stock option grant and is payable on December 31, 2003. Such payments may be deferred under the Company’s Executive Deferred Compensation Plan. The mirror cash payment is calculated similar to the amounts due under the stock option element, described above, except Mr. Roemer shall not be entitled to receive payments if he were to terminate services with ProQuest Company prior to December 31, 2003 for any reason, including resignation, termination, death or disability. In the event of a change of control of the Company, Mr. Roemer would be entitled to an accelerated payment under the arrangement. In addition, the $3,000,000 Mr. Roemer earned for his efforts in completing the divestiture of the Company’s Imaging division will be applied against any amount due Mr. Roemer under the mirror cash payment. In summary, if the Company stock price is less than $23.89 per share as of December 31, 2003, Mr. Roemer will receive no additional compensation under the mirror cash element of the arrangement. If the stock price is equal to or greater than $23.89 per share as of December 31, 2003, then Mr. Roemer shall receive an amount equal to the stock price per share less $16.50 multiplied by 406,250, the product of which shall be reduced by $3,000,000.

Of the options to purchase 385,000 shares of ProQuest common stock granted to Mr. Roemer in May 1995, 154,000 shares are currently exercisable and 77,000 have expired. Mr. Roemer previously exercised his option to purchase and sold the remaining 154,000 shares granted in May 1995. Mr. Roemer was also granted stock options in February 1998 for 250,000 shares, all of which are vested and 100,000 shares in February 1999, all of which are vested. With respect to all option grants to Mr. Roemer, if he were to leave the Company for reasons other than disability or death before any of the respective vesting dates, he would forfeit his right to all unvested shares.

As a Director of Bigchalk, Mr. Roemer was granted an option to purchase shares of Bigchalk. Mr. Roemer exercised this option and purchased 105,833 shares of Bigchalk, 87,500 of which were granted to Mr. Roemer by the Company. On December 30, 2002, the Company acquired the remaining ownership interest in Bigchalk. As a common shareholder, Mr. Roemer was entitled to receive $.0001 per common share of Bigchalk.

As a Director of MotorcycleWorld.com (MCW), Mr. Roemer was granted an option to purchase 75,000 shares of MCW in 2000. None of the options in MCW were exercised and these options have expired.

In January 2003, Mr. Aldworth was elected Chief Executive Officer of the Company. In determining Mr. Aldworth’s 2003 compensation, the Compensation Committee has focused on his ability to enhance the long-term value of the Company. During his tenure with ProQuest, Mr. Aldworth has been a leader in the revitalization of the Company and its transformation into a provider of technological solutions within a number of market segments. Mr. Aldworth has also been instrumental in improving the capital and debt structure of the Company. Mr. Aldworth’s total compensation is based on both ProQuest’s recent performance and his contributions to the overall long-term strategy and financial strength of the Company.

DEDUCTIBILITY OF COMPENSATION IN EXCESS OF $1,000,000 PER YEAR

Internal Revenue Code Section 162(m), in general, precludes a public corporation from claiming a tax deduction for compensation in excess of $1,000,000 in any taxable year for any executive officer named in the

summary Compensation table in such corporation’s proxy statement. Certain performance-based compensation is exempt from this tax deduction limitation. The Compensation Committee’s policy is to structure executive compensation in order to maximize the amount of the Company’s tax deduction. However, the Compensation Committee reserves the right to deviate from that policy to the extent it is deemed necessary to serve the best interests of the Company.

*****

The foregoing report on executive compensation is provided by the following members of the Compensation Committee during 2002:

William E. Oberndorf (Chairman), David Bonderman and Gary L. Roubos.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

Messrs. Oberndorf, Bonderman, and Roubos are the members of the Compensation Committee. No member of the Compensation Committee is an officer of the Company. No member of the Compensation Committee served as a director or member of the Compensation Committee of another entity, one of whose executive officers served as a director or member of the Compensation Committee of the Company.

COMPENSATION AND STOCK OWNERSHIP INFORMATION

The following table sets forth the compensation paid by the Company or a subsidiary of the Company to the Chief Executive Officer and each of the other four most highly compensated executive officers of the Company at the end of fiscal 2002 for fiscal years 2002, 2001 and 2000:

ANNUAL COMPENSATION | LONG TERM COMPENSATION | |||||||||||||||||

AWARDS | PAYOUTS | |||||||||||||||||

Name and Principal Position | Fiscal Year | Salary ($) | Bonus(2) ($) | Other Annual Compensation ($) | Securities Underlying Options/SARs(3) (#) | LTIP Payouts(4) ($) | All Other Compensation ($) | |||||||||||

James P. Roemer(1) | 2002 |

| 675,002 | 323,022 | 521,967 | (13) | 0 |

| 0 | 11,551 | (5) | |||||||

Chairman of the Board, ProQuest Company | 2001 2000 |

| 674,146 630,006 | 630,327 496,130 | 2,515,495 | (13) | 406,250 75,000 |

(14) | 42,000 | 8,562 218,062 | (5) (5) | |||||||

Alan W. Aldworth(1) | 2002 |

| 398,077 | 134,470 | 51,726 | (13) | 80,000 |

| 0 | 96,996 | (6) | |||||||

President and Chief | 2001 |

| 311,532 | 205,611 | 314,306 | (13) | 66,000 |

| 0 | 57,008 | (6) | |||||||

Executive Officer, ProQuest Company | 2000 | (11) | 56,536 | 33,922 | 50,000 |

| 12,583 | (6) | ||||||||||

Joseph P. Reynolds | 2002 | (12) | 278,237 | 0 | 16,658 | (13) | 26,200 |

| 0 | 140,586 | (7) | |||||||

2001 |

| 310,383 | 118,442 | 662 |

| 26,500 |

| 0 | 125,485 | (7) | ||||||||

2000 |

| 299,991 | 171,000 | 56,000 |

| 0 | 225,020 | (7) | ||||||||||

Bruce E. Rhoades | 2002 |

| 231,000 | 110,603 | 21,203 | (13) | 0 |

| 13,333 | 58,595 | (8) | |||||||

President and CEO | 2001 |

| 262,532 | 122,025 | 0 |

| 50,000 |

| 13,333 | 6,747 | (8) | |||||||

ProQuest Business Solutions | 2000 |

| 220,076 | 85,529 | 0 |

| 30,000 |

| 5,262 | (8) | ||||||||

Todd W. Buchardt | 2002 |

| 257,308 | 72,432 | 33,215 | (13) | 22,000 |

| 0 | 63,551 | (9) | |||||||

General Counsel, ProQuest Company | 2001 2000 |

| 238,001 206,308 | 130,901 93,151 | 561,782 | (13) | 18,000 45,000 |

| 13,200 0 | 54,773 22,870 | (9) (9) | |||||||

20,000 | (14) | |||||||||||||||||

Linda Longo-Kazanova | 2002 |

| 209,050 | 58,848 | 167,116 | (13) | 18,000 |

| 0 | 54,126 | (10) | |||||||

Sr. Vice President | 2001 |

| 199,232 | 109,578 | 211,531 | (13) | 0 |

| 0 | 5,104 | (10) | |||||||

Human Resources, ProQuest Company | 2000 |

| 116,924 | 81,847 | 36,171 |

| 0 |

| 0 | 3,934 | (10) | |||||||

LTIP = long-term incentive plan

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table lists information concerning the stockholders known by the Company to beneficially own more than five percent of the Company’s Common stock as of February 28, 2003, except as noted in the footnotes below.

Name and Address of Beneficial Owner | Number of Shares | Percent | |||

Tweedy Browne Company LLC(1) 350 Park Avenue New York NY 10022 | 4,105,199 | 14.6 | % | ||

Keystone Inc.(2) 3100 Texas Commerce Tower 201 Main Street Fort Worth, Texas 76102 | 2,612,999 | 9.3 | % | ||

William E. Oberndorf(3,4) SPO Partners & Co. 591 Redwood Highway Suite 3215 Mill Valley, CA 94941 | 2,601,552 | 9.3 | % | ||

John H. Scully (3,5) SPO Partners & Co. 591 Redwood Highway Suite 3215 Mill Valley, CA 94941 | 2,446,962 | 8.7 | % | ||

SPO Advisory Corp. (6) 591 Redwood Highway Suite 3215 Mill Valley, CA 94941 | 2,153,600 | 7.7 | % | ||

Reich & Tang Asset Management, LLC (7) 600 Fifth Avenue New York, NY 10020 | 1,548,000 | 5.5 | % | ||

Sterling Management, Inc(8) 4064 Colony Road, Ste. 300 Charlotte, NC 28211 | 1,404,370 | 5.0 | % |

OWNERSHIP INFORMATION OF DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth information with respect to the beneficial ownership of ProQuest Common stock, as of February 28, 2003 of the Company’s Directors, the executive officers listed in the “Summary Compensation” table above, and the directors and executive officers as a group.

Directors and Executive Officers: | Number of Shares | Percent | |||

William E. Oberndorf(1,2) | 2,601,552 | 9.3 | % | ||

John H. Scully (1,3) | 2,446,962 | 8.7 | % | ||

James P. Roemer(4) | 572,503 | 2.0 | % | ||

David Bonderman(5,6) | 366,915 | 1.3 | % | ||

Alan Aldworth(4) | 127,307 | * |

| ||

Todd Buchardt(4) | 66,516 | * |

| ||

Bruce Rhoades(4) | 59,333 | * |

| ||

William J. White (7) | 47,657 | * |

| ||

Linda Longo-Kazanova (4) | 39,476 | * |

| ||

Gary L. Roubos (6) | 15,066 | * |

| ||

Joseph P. Reynolds | 14,900 | * |

| ||

David G. Brown (8) | 13,362 | * |

| ||

All directors and executive officers as a Group (13 Persons) | 4,217,949 | 15 | % |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires that certain of the Company’s directors, executive officers, the chief accounting officer and 10% shareholders (“Insiders”) file with the Securities & Exchange Commission (SEC) and the New York Stock Exchange reports disclosing their beneficial ownership and any changes in ownership of the Company’s common stock. Based upon review of such reports it has received and based upon written representations that no other reports were required, during the year ended December 31, 2002, the Company is not aware of any instances of noncompliance or late compliance with 16(a) filing requirements, except due to administrative errors, the late reporting of an option exercise and sale of 4,200 shares of Company stock by Mr. Bruce Rhoades on March 7th and 13th, 2002 and the purchase of 500 shares of Company stock on October 29, 2002 by Mr. Kevin Gregory. All of these transactions have been reported.

II. OPTION GRANTS IN LAST FISCAL YEAR(1)

Individual Grants | Potential Realizable Value of Assumed Annual Rates of Stock Price Appreciation for Option Term (3) | |||||||||||||

Name | Number of Securities Underlying Options Granted(2) (#) | Percent of Total Options Granted to Employees in Fiscal Year | Exercise or Base Price ($/Sh) | Expiration Date | 5% ($) | 10% ($) | ||||||||

James P. Roemer | 0 |

| 0.00 | % | 0.00 | 0 | 0 | |||||||

Alan W. Aldworth | 80,000 | (4) | 20.01 | % | 33.80 | 01/07/12 | 1,700,531 | 4,309,480 | ||||||

Joseph P. Reynolds | 26,200 | (5) | 6.55 | % | 36.00 | 03/06/12 | 593,173 | 1,503,218 | ||||||

Bruce E. Rhoades | 0 |

| 0.00 | % | 0.00 | 0 | 0 | |||||||

Todd W. Buchardt | 22,000 | (4) | 5.50 | % | 36.00 | 03/06/12 | 498,085 | 1,262,244 | ||||||

Linda Longo-Kazanova | 18,000 | (4) | 4.50 | % | 36.00 | 03/06/12 | 407,524 | 1,032,745 | ||||||

III. OPTION EXERCISE AND FISCAL YEAR-END VALUE TABLE

Name | Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values(1) | |||||||||||

Shares Acquired on Exercise (#) | Value Realized ($)(3) | Number of Securities Underlying Unexercised Options at Fiscal Year-End | Value of Unexercised In-the-Money Options at Fiscal Year-End (2) | |||||||||

(#) Exercisable | (#) Unexercisable | ($) Exercisable | ($) Unexercisable | |||||||||

James P. Roemer | 0 | 0 | 504,000 | 406,250 | 0 | 1,259,375 | ||||||